Why a Weaker Dollar is good for America

For a long time now we have been exposed to the US President ,Treasury Secretary and various Senators talking about the benefits of a strong Dollar and how that is in the interests of America.This is really all just political rhetoric the reality is somewhat different .  In its current situation the last thing that the US needs or wants is a strong dollar- but unfortunately it just isn't politically the right thing to say.So why is a weak dollar good for America ?

In its current situation the last thing that the US needs or wants is a strong dollar- but unfortunately it just isn't politically the right thing to say.So why is a weak dollar good for America ?

Well if anyone has been to the US recently or if you are indeed a US citizen you cannot fail to have noticed the increased prevalence of foreign accents that seem to be in every restaurant or store.It seems that America is on sale and the rest of the world is buying. Since 2002 the dollar is down about 25% and the rest of the world is taking advantage .Not only do they flock in their droves to the US to spend their money but it is good for exporters as well who find that demand for their goods increases the more the dollar weakens.

Tourism is a huge industry for the US but not only for attracting foreigners to its shores but as the dollar weakens and it becomes more expensive to go abroad more and more Americans are opting for Disneyland Florida and not Disneyland Paris. Not only does the weaker dollar make it more attractive to vacation there but it also makes it far more attractive for foreign investors -whether it is the huge cash piles of some of the Far East and Middle Eastern Sovereign Wealth funds or someone looking for a US holiday or retirement home

Foreign ventures put $407 billion to work in the U.S. in 2007. That was a 93% increase over 2006. The Chinese, in particular, were an active bunch. Chinese investment soared from only $66 million in 2006 to $9.6 billion last year.American assets should attract even more foreign buyers this year. The Chinese are eyeing American timberlands, for example. American farmland, mines and other hard assets must also seem cheap.The weak dollar affects things in a couple of ways. On the one hand, it makes imports more expensive. So far, a weak dollar has not stopped imports from growing nationally, though it has slowed the pace. On the other hand, the weak dollar has really benefited America's export engine as I indicated above.

Exports grew twice as fast as imports in 2007. For the first time since 1995, the gap between the two narrowed. America's commodity producers get a lot of help when the dollar falls. They incur their costs in dollars. Yet they sell into the global market for metals, minerals and other commodities. Global prices are all near multiyear highs, thanks in some measure to the weak purchasing power of the dollar.

America's manufacturers - what's left of them - also gain. Strong demand from overseas drives their sales. Suddenly, America's goods look cheap. "Foreign demand for advanced machinery is huge," reports The Economist. "Civilian aircraft, drilling tools, agricultural machinery and excavators all rose at double-digit rates in 2007."

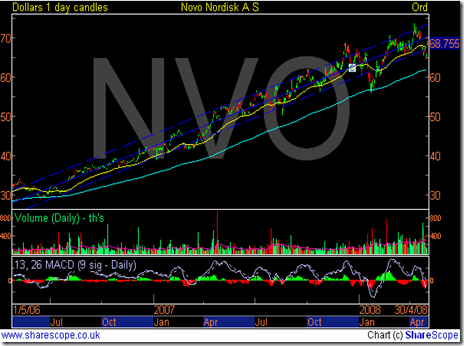

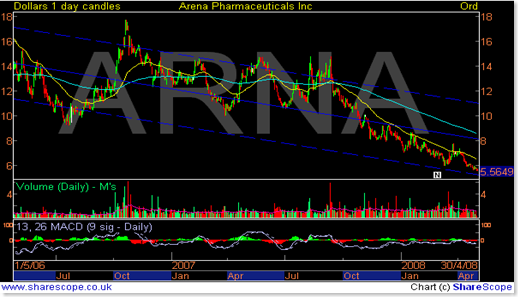

So in terms of investment opportunities we should be thinking about companies that export a lot of their goods overseas and possibly those in the Hospitality and tourist industries. So no matter what Hank Paulson and his cronies trot out at each press conference the weaker the US dollar gets the more likely they are to be able to find a way out of their current situation and to reduce the Current Account deficit.

Best Wishes

Alan