It wasn't that long ago that Goldman Sachs printed the "crazy prediction that Crude oil would reach over $100 a barrel .well they are at it again and who would dare doubt them this time. The story below from Bloomberg quotes the analyst behind that earlier prediction Arjun Murti as saying that within two years we could be seeing oil hitting between $150 and $200 a barrel. I wrote about Peak Oil and its impact in this article Has Oil Peaked ?

Based on this prediction it most definitely looks like there is a growing acceptance(unless you are a Politician or in Saudi Arabia) that we may actually be running out of oil. If this prediction comes true (like the last one did) then it really will have some ramifications for the world economy and possibly also stability.

May 6 (Bloomberg) -- Crude oil may rise to between $150 and $200 a barrel within two years as growth in supply fails to keep pace with increased demand from developing nations, Goldman Sachs Group Inc. analysts led by Arjun N. Murti said in a report.

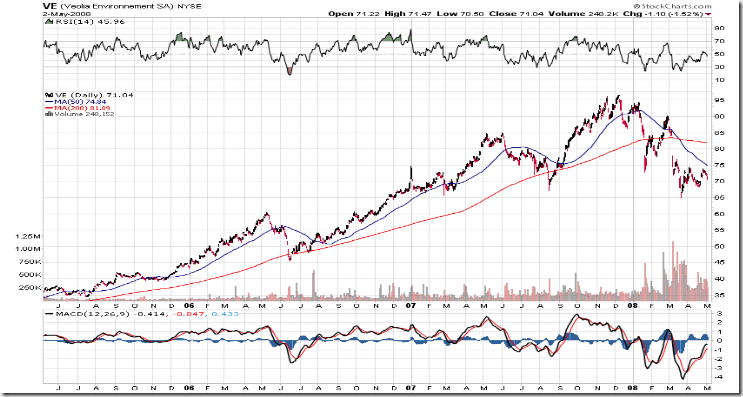

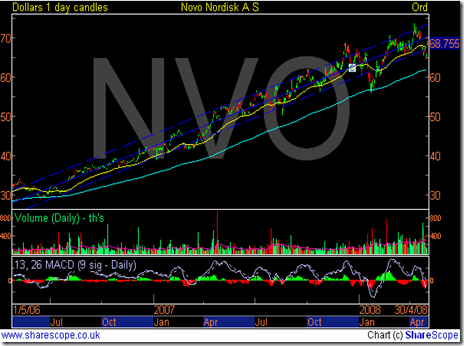

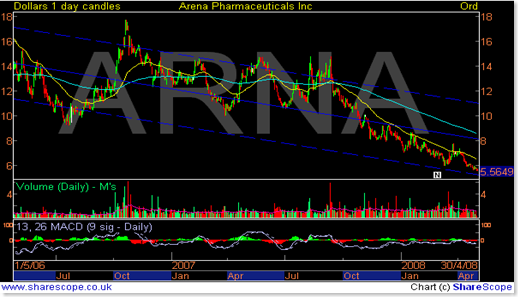

The price of crude traded in New York averaged $56.71 in 2005, $66.23 in 2006 and $72.36 in 2007. Oil rose to an intraday record $120.93 today on speculation demand will rise during the peak U.S. summer driving season.

``The possibility of $150-$200 per barrel seems increasingly likely over the next six-24 months, though predicting the ultimate peak in oil prices as well as the remaining duration of the upcycle remains a major uncertainty,'' the Goldman analysts wrote in the report dated May 5.

A report yesterday showed U.S. service industries expanded in April, signaling higher energy use. The Institute for Supply Management said its index of non-manufacturing businesses, which make up almost 90 percent of the economy, grew for the first time since December. China is increasing refining capacity and boosting imports to meet rising demand for the Olympic Games.

U.S. gasoline demand typically climbs going into the summer season when Americans take to the highways for vacations. The peak-consumption period lasts from the Memorial Day weekend in late May to Labor Day in early September. Monthly fuel sales were the highest during August in five of the last six years, according to data from the Department of Energy.

China Consumption

China, the world's fastest-growing major economy, has more than doubled oil use since New York crude oil dropped to this decade's low of $16.70 a barrel on Nov. 19, 2001. Record prices have failed to stem rising consumption in developing nations, with demand led by China, India and the Middle East.

Price forecasts for spot U.S. benchmark West Texas Intermediate crude oil for 2008 to 2011 were revised higher by Goldman. The 2008 price estimate was raised to $108 a barrel from $96, the 2009 forecast to $110 from $105, and 2010 to 2011 estimates are projected at $120 from $110, the analysts said, citing slowing supply growth in Mexico and Russia, and low spare production capacity in OPEC.

Oil has also rallied amid a dispute between the U.S. and Iran regarding the Persian Gulf oil producer's plan to develop nuclear energy.

In Nigeria, Africa's biggest oil exporter, militants have attacked oil installations and kidnapped workers since the beginning of 2006, forcing Royal Dutch Shell Plc to halt output.

Venezuela Slump

In Venezuela, production has slumped to about 2.34 million barrels a day from almost 3 million barrels a day in 2002, according to Bloomberg's estimates, before President Hugo Chavez fired almost 20,000 workers who had closed the state oil company in an attempt to overthrow the government.

Iraq's oil production has yet to reach levels attained before the U.S.-led invasion of 2003 as the country struggles with sectarian fighting and attacks on its energy infrastructure.

Mexico's production has fallen below 3 million barrels a day since October as Petroleos Mexicanos, the state-owned oil company, failed to compensate for a 30 percent drop at Cantarell, its largest field, which accounts for 40 percent of output.

``There are supply constraints with many producers, especially from non-OPEC struggling to find new reserves and China and Middle East demand keeps growing,'' said Victor Shum, senior principal at energy consultant Purvin & Gertz Inc. in Singapore. ``The fundamentals are prompting investors to get into oil in a big way and all that points to higher prices.''

OPEC Capacity

Spare production capacity of the Organization of Petroleum Exporting Countries is low and the group's exports may fall because of ``lackluster'' supply growth and rising domestic consumption in member countries, the Goldman analysts said.

``Non-OPEC supply is struggling to grow, with notable declines being seen in Mexico and Russia showing signs of rolling over following an extended period of rapid growth,'' said the analysts from Goldman, the world's biggest securities firm by market value.

Prices are also poised to gain as major oil-exporting countries restrict foreign investments, limiting supply growth, while demand from developing countries, or ``non-OECD'' nations is rising on economic expansion and power shortages, prompting higher demand for gasoil and fuel oil, the Goldman analysts said.

Crude oil for June delivery was trading at $120.47 a barrel, up 50 cents, at 8:42 a.m. in London in after-hours trading on the New York Mercantile Exchange. Yesterday, futures closed 3.1 percent up at $119.97 a barrel, the highest closing price since trading began in 1983.

`Super-Spike'

``The core of our super-spike view has been that a lack of adequate supply growth coupled with price-insulated non-OECD demand growth'' is leading to higher prices, the analysts said. That could result in a ``sharp correction in oil demand,'' the Goldman analysts said.

Crude oil's increase above $100 a barrel was partly because of the dollar's decline against the euro, which boosted oil prices because it made commodities cheaper for buyers outside the U.S. and attracted investors as a hedge against inflation. Oil in New York touched $100 a barrel on Jan. 2.

The U.S. currency has declined 5.4 percent against the euro so far this year, and 11 percent last year.

Members of OPEC, which supplies about 40 percent of the world's oil, have said supplies are adequate and blamed speculators for pushing prices up to records. The producer group won't consider raising output before it meets in September as the market is well supplied, Qatari Oil Minister Abdullah al-Attiyah said on May 2.

There's a fundamental misperception that so-called speculators are driving prices to unjustified levels, the Goldman analysts said. ``Unfortunately, we do not think the energy crisis will be solved by finding and punishing the big bad speculator.''

Commodity investors, the Goldman analysts wrote, are ``helping to solve the energy crisis'' by speeding up the process for oil companies to spend more on energy projects and at the same time encourage efficiency.