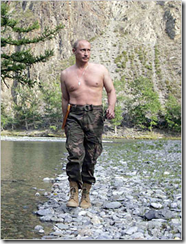

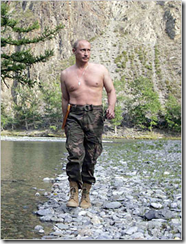

Vladimir Putin has taken leave of office and is being "replaced" by Dmitry Medvedev.Despite what some may think in the West ,Putin is extremely popular in Russia.During his premiership Russia has had a remarkable economic transformation . Since the early nineties the Russian Economy has been growing at a remarkable rate of 8% per annum.

Most of this growth has been down to the massive reserves of Natural resources that it can draw on particularly Oil, Gas and Precious Metals.The demand for these Natural resources from the emerging countries such as China and India has fuelled a boom that has seen a thriving middle class developing in Russia.

Like all middle classes these Russians are splashing out on cars, holidays and electronic goods. There is no doubt that some people may have concerns about investing in Russia, we can all remember when the Russian government was seizing power of Yukos and we were hearing stories of the "Red Mafia" running wild.However those who have invested in Russia in the past few years have seen some serious returns.

Russia is amongst the cheapest of the emerging market economies, it has huge resources of natural commodities that the world is crying out for and importantly at the moment has little or no exposure to the credit crisis that is impacting on a number of the rest of the worlds major economies. Some people may not like Vladimir Putin but you cannot fault what he has achieved in the economy.

The Case for Investing

The case for investing in Russia is based mainly on energy.It has vast oil reserves in its Western States and a third of the Worlds gas reserves sit in Siberia, this makes Russia by far the worlds biggest gas exporter and producer. On top of this its neighbours have an increasing reliance on buying from Russia. Over 20% of the EU's natural gas comes from Russia.

The current record prices for oil means that the Kremlin is generating a fortune in taxes that it has levied on the oil producers. It is estimated that Russia takes in over 80% of every dollar that the price of oil increases at the current levels.Learning from the past where they squandered the wealth that these Natural Resources generated Russia has created its own Sovereign Wealth Fund which is known as the Stabilisation Fund.The current estimates are that this fund has something in the region of $150bn.Russia also must be the envy of many economists and politicians in the west in that it is estimated to have a budget surplus of 5-6% of GDP.

Downside Risks

As with all things where there is the potential of high reward there is attached risk, there is no doubt that there are risks associated with investing in Russia.State ownership has always meant that investment levels tend to lag behind what you would expect from private ownership.This is certainly the case in Russia, the limited investment in the Siberian Oil fields has seen an impact over the years in the levels of production growth.In the late 90's estimates were that production growth was around 10% per annum, the estimates now are that this has dropped to around 1%.

The picture with gas however is more rosy the Kremlin has been very active encouraging ( some would say bullying) big Gas companies such as BP into investing in infrastructure in Central Asia.Putin has also got agreement from countries in the Caspian Region which allow Russia to get access to the reserves in the area for a fraction of what they are worth to the West so when selling these on to countries in the EU Russia is guaranteed a tidy mark-up.

One of the other potential downsides for to consider for the future is infrastructure, since the collapse of the Soviet Union there has been a major decline in the maintenance of Russia infrastructure, transport networks are very underdeveloped and this will have an impact on its competitiveness if plans are not soon put in place to invest in the road and rail network a s well as the oil and gas pipelines.

s well as the oil and gas pipelines.

The Russian government has recognised this and plans to throw around $1trn at the problem. The Kremlin has committed around $200bn with the rest coming from the private sector.

What to Buy ?

In my next post I will look at some of the ways and companies that could do well on the back of the continued boom in Russia .

Best Wishes

Alan