Palladium is it the next Platinum ?

The precious metals are taking a breather at the moment pulling back off their highs, Palladium is no exception, having reached a 6 year high recently of $580 an ounce, it has now pulled back by over $100 an ounce.

The long term outlook for the metal however still looks promising and since it is not as high profile as Gold and Platinum may also offer some real potential in the mid to long term.One of the major countries that mines Palladium is South Africa.The recent problems regarding power cuts in the country have had an impact in the mining of Palladium, South Africa accounts for about 30% of the worlds production of Palladium so any disruptions to the supply here have a major impact on the price.

The power situation in South Africa is still fragile and any further disruptions would certainly cause another spike in the price, power issues aside, there are other fundamental issues which also give support to the view that Palladium is likely to go higher in the medium term.The recent run up in Platinum is a key factor here with the record prices seen recently making Palladium an attractive option for the autocatalyst market as well as the jewellery market.With the increasing purchase of cars in the emerging markets such as China and India then the demand for Palladium to be used in catalytic converters is only likely to increase .

The other major supplier of Palladium is Russia, in recent years they have been keeping the market well supplied but lately these supplies have been slowing ,adding further constraints into the supply chain, there are some who believe that the Russian supplies are starting to run out if that is the case then this will be another reason for Palladium to start to move higher. The increasing interest in Precious Metals is also likely to create demand as people look to other metals beyond Gold as the fear of inflation and a sinking dollar add to the safe haven status of Precious Metals.

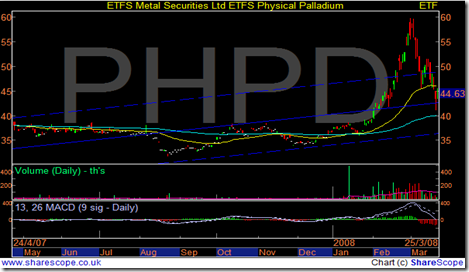

The best way to take advantage of buying Palladium is via the London traded ETF (PHPD), it is also possible to gain exposure to Palladium via the ETF (PHPP) which gives exposure to all 4 metals, Gold, Silver, Platinum and Palladium.I added some PHPD to my portfolio today at $48.77 as well as some more of the Silver ETF (SLV) .A chart of the recent prices showing the latest pullback is below.I think this pullback may be a good buying opportunity for anyone who believes in the metals longer term.

Best Wishes

Alan

|